Futa suta calculator

If you are a liable employer under state law you may also be required to pay under the Federal Unemployment Insurance Tax Act FUTA. State and Federal Monthly Trust Fund Balances.

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

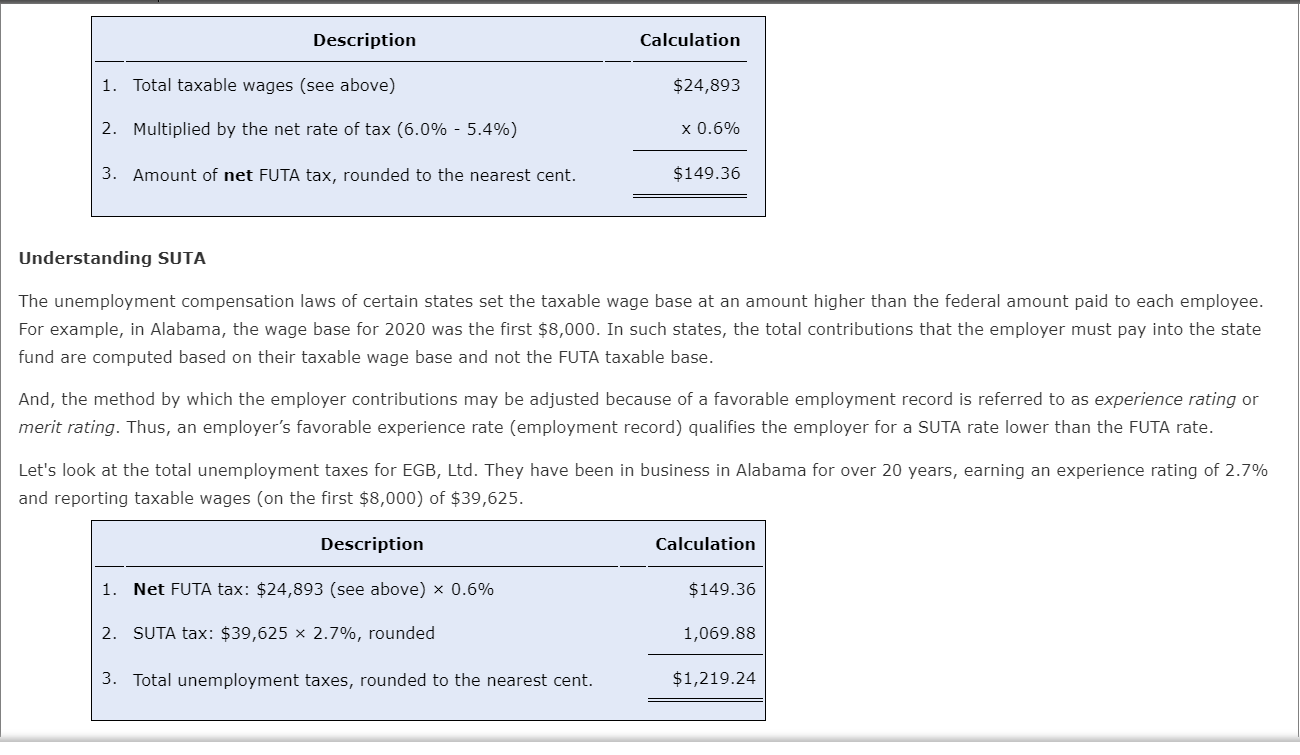

Apart from income and FICA taxes you need to pay the Federal Unemployment Tax Act FUTA and state unemployment taxes SUTA.

. I really like the simplicity and price of Wagepoint. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base. Free payroll tax withholding calculator to help with state local and federal tax.

Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first 7000 of each. FutaPct futaBurden SUTA 1. Weve put in some very standard rates for FICA FUTA and SUTA for display purposes.

How is FUTA Calculated. How to Calculate Payroll Taxes with Gusto. This adds up to the total payroll taxes you must pay.

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Employers remit withholding tax on an employees behalf. Unemployment insurance FUTA 6 of an employees first 7000 in wages.

The cost will be displayed for one hour of labor. Estimated FUTA Receipts vs. This federal tax helps finance South Dakota Department of Labor Programs such as placement labor market information and training of workers to meet industry needs.

Enter those two numbers in the GL Rate and WC Rate of the calculator. As Barrys employer you remit 150 of SUTA taxes at the end of March and 60 at. Unemployment insurance SUTA 5.

The FUTA and SUTA taxes are filed on Form 940 each year. Self-employed individuals need to take the Medicare and Social Security amounts from the calculator and subtract it from net income to obtain an accurate number. Although its manageable to calculate payroll taxes manually this isnt recommended.

Informal communication is casual communication between coworkers in the workplace. 30 is an estimate. Kerzdenn Kowalchuk Vizeer Services LLC As part of an entrepreneurship network Im always searching for platforms that are ideal for startups.

It also pays the administrative costs of the. SutaPct. See how FICA tax works in 2022.

FUTA taxes are administered at the federal level. If you are paying the state unemployment tax then the calculation is. Amounts Returned State and Federal Tax PublicationsForms and Contacts.

Note the higher wage rate of 6. EFTPS allows you to pay FICA federal income and federal unemployment taxes. It is unofficial in nature and is based in the informal social relationships that are formed in a workplace outside of the.

Repeat as many times as needed to see the cost of one hour of labor for each labor classification your employees perform. FUTA the federal insurance tax is calculated in a very similar way to state unemployment. It fits perfectly in line for business startups that need something legit in place but dont need larger more complicated payroll platforms.

Without a streamlined and reliable payroll system in place businesses may face tough consequences including poor employee retention minimal. This reflects the self-employment tax and this video is a paycheck city tutorial. The business stops paying SUTA tax on Barrys wages once he makes 7000 which happens in the middle of Q2.

Salary or 7000 6 FUTA. Payroll is best defined as the total of all compensation an employer must pay to its employees for a specified range of time. Taxes require accuracy and a small mistake in your calculations can lead to disaster in the future.

During times of high unemployment states may borrow from FUTA funds helping provide benefits to locally unemployed people. Theyre used for oversight of state unemployment programs. Payroll admins need to be able to quickly and easily create actionable reportsnot only for informing business strategy but to carry out essential tax functions ensure future payroll runs and more.

It is extremely helpful to have an accurate time tracking solution so. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. As a result employers must also contribute a matching portion for FICA taxes.

If youve opted out of your state unemployment insurance for tax reasons your calculation is. While there are many different elements of running a business one of the most important is payroll. This is especially true if you have a lot of.

SUTA rates vary depending on your unemployment claims in different states. Informal Communication in the Workplace. Use this calculator to quickly calculate payroll yourself.

Reporting is a must-have functionality when it comes to payroll. Use ClockSharks free labor burden calculator to help you accurately calculate what your labor burden is. Other taxes such as an employer-paid family leave tax 6.

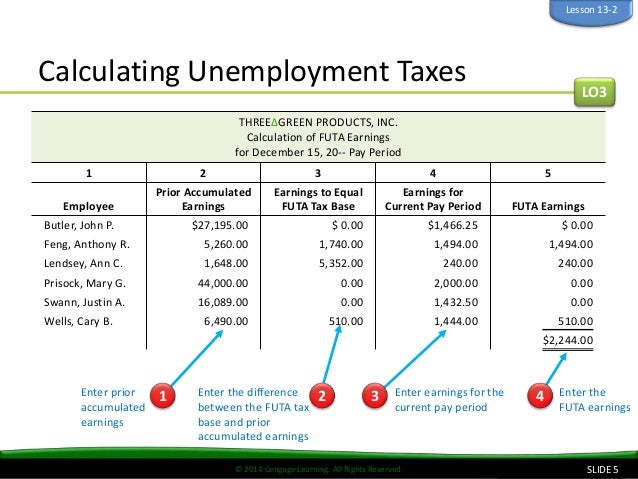

Solved Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Payroll Tax Calculator For Employers Gusto

Fjio0zhlyhmodm

Futa Tax Overview How It Works How To Calculate

Formulate If Statement To Calculate Futa Wages Microsoft Community

Calculating Suta Tax Youtube

Calculating Futa And Suta Youtube

How To Calculate Unemployment Tax Futa Dummies

Employer Futa Suta Contributions Understanding Futa Chegg Com

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

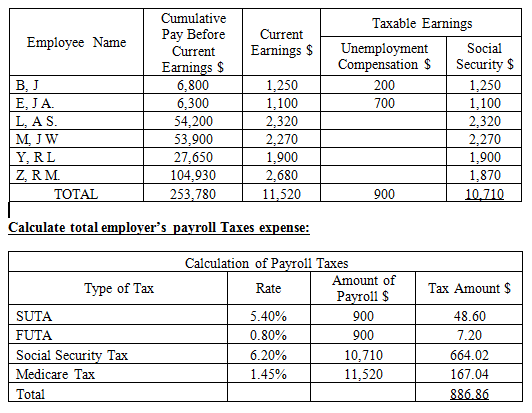

Solved Calculation Of Taxable Earnings And Employer Payroll Taxes Chegg Com

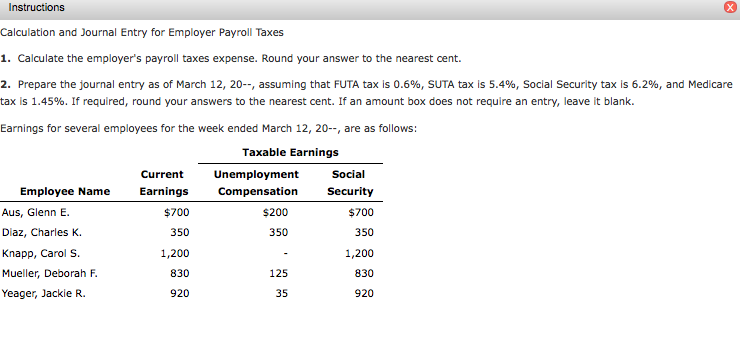

Solved Instructions Calculation And Journal Entry For Chegg Com

How To Calculate Payroll Taxes Futa Sui And More Surepayroll